What we did

Market Research

Segment Research

Brand Name

Logo Design

Messaging

UI/UX

Prototype

HAVENLY | Background

Sometimes you land a project so meaningful that it fires up every part of your brain and leaves you awake at night thinking about it. Financial fraud against the aging population was the topic.

In collaboration with our friends at Trabian, a west coast bank asked us to identify an under-served user segment. Our research revealed that that adults over 70 had been left behind by today’s banking apps. We were assigned to produce a prototype that would combat the rising trend of online fraud committed against the elderly.

Havenly’s features focus primarily upon increased security measures and financial independence for aging users. The app also offers ease and security to users who may be suffering from cognitive decline.

A safe, gentle, approachable brand

A “safe place” was the driving theme which led to the app’s name and logo design. A cardinal guarding its nest seemed like an appropriate metaphor.

We took a minimalist approach to a classic style, establishing soft, contrasting colors that could effectively extend throughout the interface design.

An End-to-end Boutique Experience

From guided registration to softening the anxiety of identity verification, we mapped out an empathetic user experience that leads them at a comfortable pace.

The user is supported by a virtual assistant, nested video tutorials and a help button that will get them support from a live human being at any moment.

Security Scoring

In order to reduce vulnerability to fraud, Havenly calculates the user’s security score. They are periodically encouraged to increase their score by taking one of several suggested actions.

In this case, the user chooses to confirm the phone number listed on their account, increasing their security score from a B- to a B+.

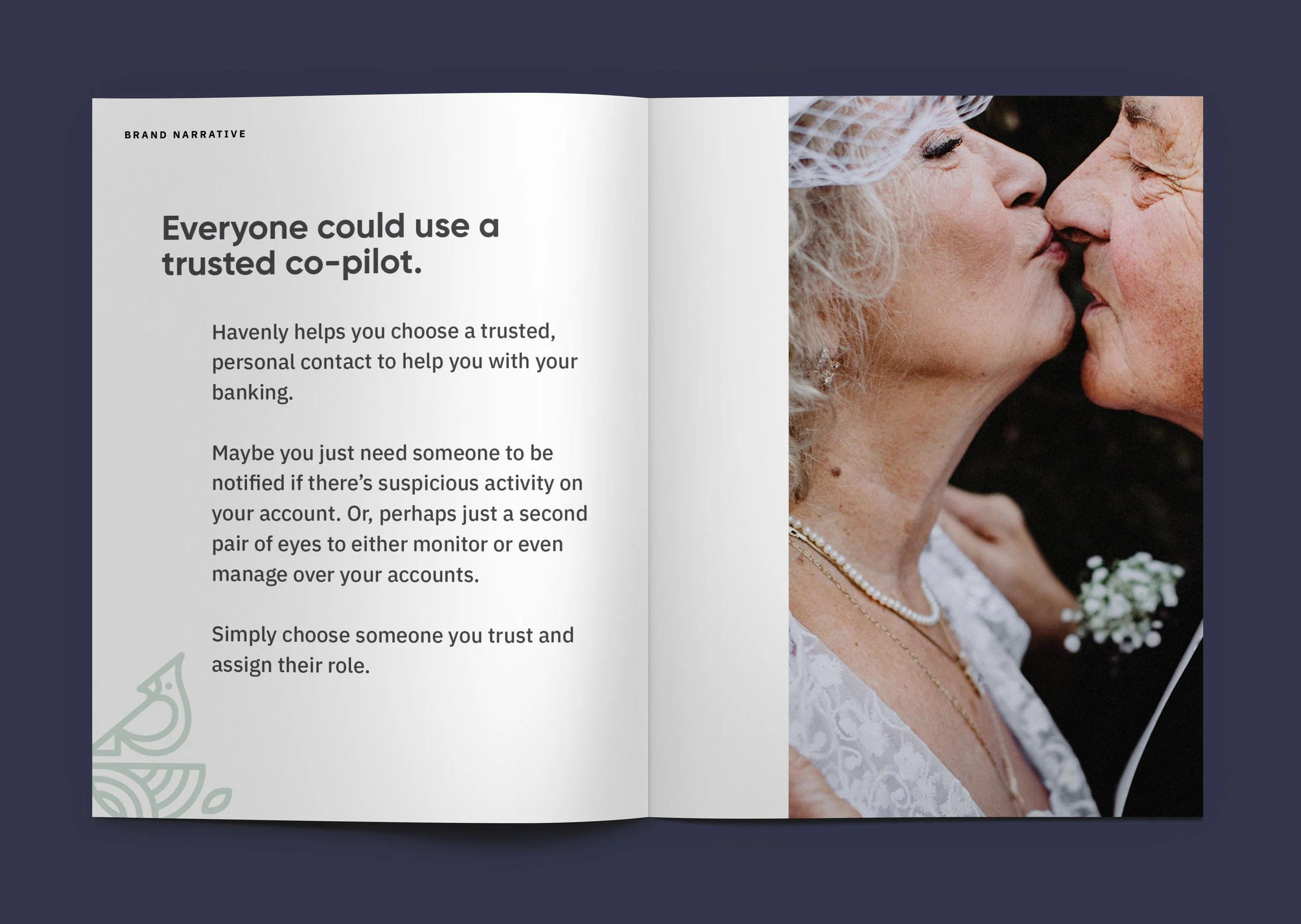

The user can assign a trusted contact to assist them in monitoring or even managing their accounts.

The user will determine the permission level of the trusted contact, such as receiving alerts for suspicious activity, viewing transactions, or even taking full control over their accounts.

The trusted contact receives an invitation, downloads the app, and gains trusted status upon their initial login. The user may remove them at any time.

Trusted Contact

A trusted contact receives a notification about a suspicious transaction on their aunt’s account.

Because the trusted contact already has permission to management over the account, he can immediately view the suspicious transaction and even take action, such locking down the account and freezing its debit card.

The trusted contact can reverse their actions once the issue is clarified and resolved.

Fraud Notifications

Messaging to the Aging User

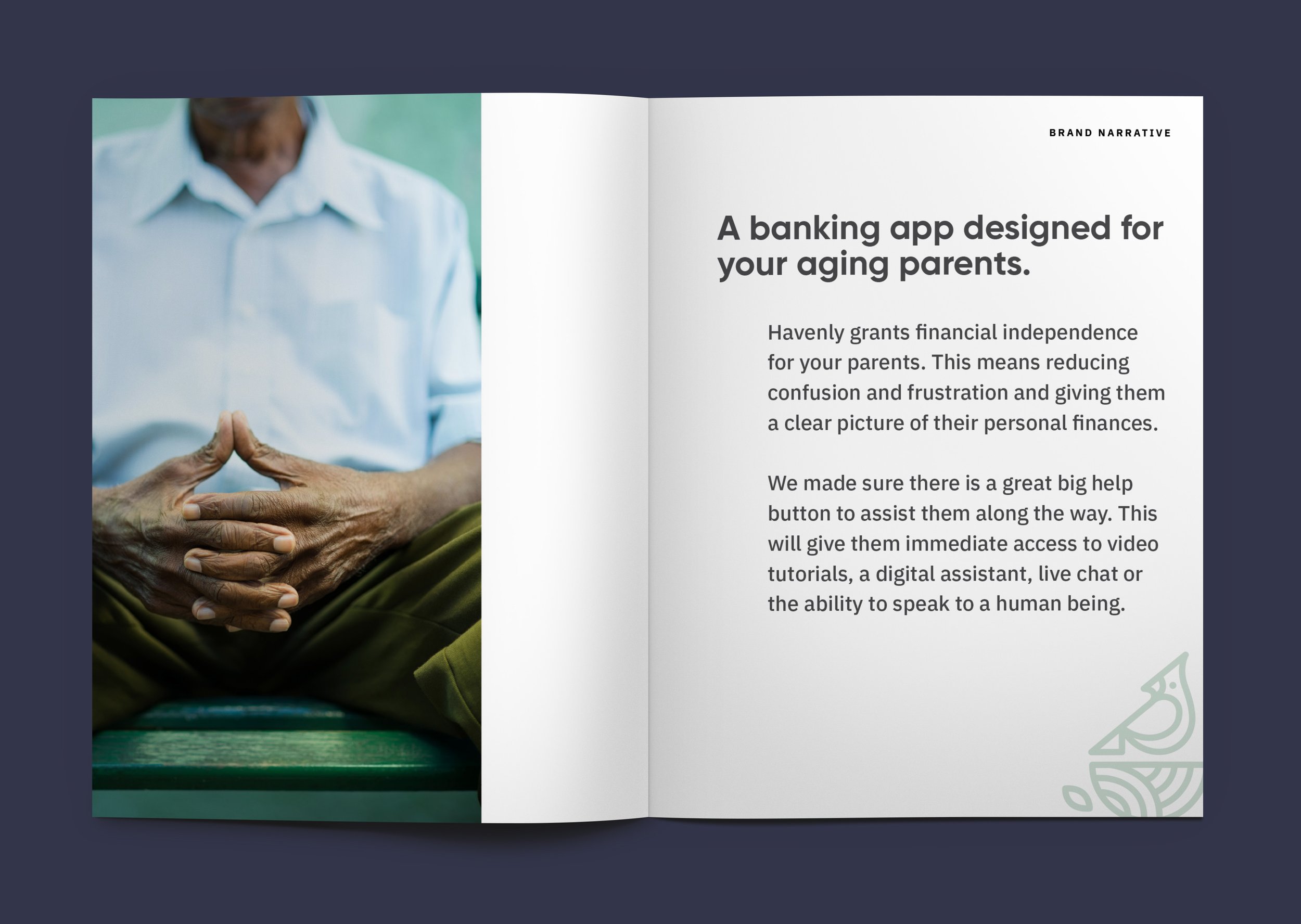

The majority of fraud is never reported by victims. It can also take a while for an aging adult to admit they feel frustrated and lost in their financial management.

We crafted a simple message that holds a mirror up to their plight and invites them to access helpful tools in collaboration with their loved ones.

Messaging to their Adult Caregiver

Adult children walk a thin line between caring for their aging parents and maintaining the dignity of their independence. Managing their finances and protecting their assets only adds to their anxiety. We crafted key messaging that appeals to their world.